What Banks Are In Trouble In 2025 - Which Banks are in Financial Trouble? A Look at the State of the, February 2, 202512:23 am pstupdated a month ago. Moody's cut ratings of 10 banks on monday. Fillable Online List of Failed Banks in the United States 2023 Recent, Et as shares in nycb, as well as other regional banks, suffered sharp losses. Banking observers will watch this month’s earnings for clues as to whether 2023’s crisis can return.

Which Banks are in Financial Trouble? A Look at the State of the, February 2, 202512:23 am pstupdated a month ago. Moody's cut ratings of 10 banks on monday.

S&p global ratings downgraded five regional us banks by one notch and signaled a negative outlook for several others on monday.

Update Banks are still in trouble YouTube, Scott rechler attends commercial observer's. Top real estate ceo warns ‘500 or more’ banks will either fail or be consolidated over the next two years.

Why The Banks Are In Trouble Godfrey Bloom Reveals All! YouTube, March 7, 2025 at 7:00 am pst. The largest lender to receive a lower rating is m&t bank, the 19th largest u.s.

Traditional banks may be in trouble due to digital banking 15 Min…, According to the mortgage banker's association, $929 billion in commercial real estate loans is due to mature in 2025, with $257 billion in multifamily and $206. Banks’ ability to generate income and manage costs will be tested in new ways.

XLF Banks Are In Trouble Again (NYSEARCAXLF) Seeking Alpha, Kre etf down 10%, loan refinancing burden rises, and technical indicators suggest a 20% drop to $37. March 7, 2025 at 7:00 am pst.

What Banks Are In Trouble In 2025. In 2025, we will see more than a dozen of these fintechs collapse, pivot, or get acquired (one of these widely hyped neobanks has already failed). S&p global ratings downgraded five regional us banks by one notch and signaled a negative outlook for several others on monday.

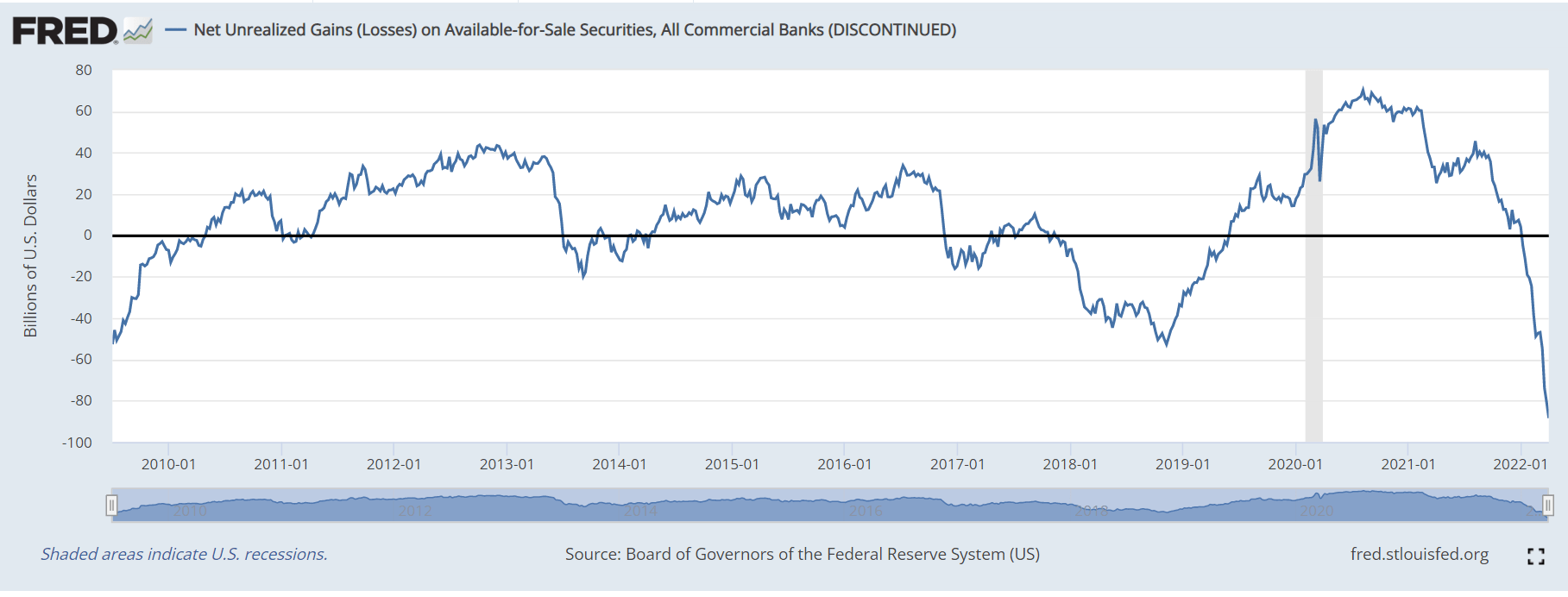

Here’s a topic that’s probably long gone from your memory:

Deadbeat Banks One Out of Five TARP Banks in Trouble, The largest lender to receive a lower rating is m&t bank, the 19th largest u.s. Regional banks will face continued challenges in 2025, with those lacking scale or focused on.

According to the mortgage banker's association, $929 billion in commercial real estate loans is due to mature in 2025, with $257 billion in multifamily and $206.

Why Banks Are In Massive Trouble Value Investing Journey, Larger regional banks will come under greater earnings pressure in 2025, due to both growing costs of maintaining deposit levels and increases in credit problems,. Bloomberg intelligence december 01, 2023.